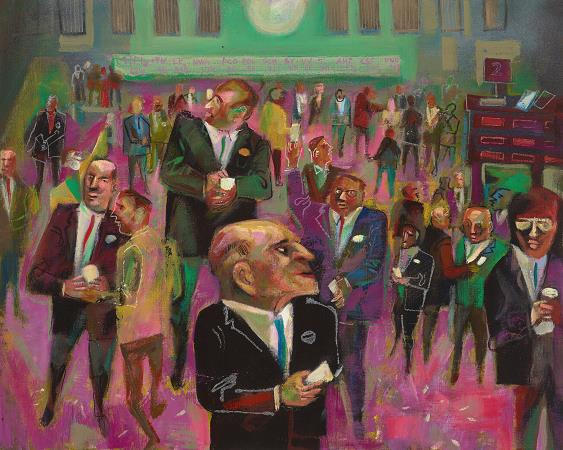

Stock Exchange. A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as continuous auction markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform. To be able to trade a security on a particular stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic communication networks, which give them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues such as electronic communication networks, alternative trading systems and dark pools have taken much of the trading activity away from traditional stock exchanges. Initial public offerings of stocks and bonds to investors is done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks. There is usually no obligation for stock to be issued through the stock exchange itself, nor must stock be subsequently traded on an exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market. Stock exchanges also serve an economic function in providing liquidity to shareholders in providing an efficient means of disposing of shares. The beginnings of lending were in Italy in the late Middle Ages.In the 1300s, Venetian lenders would carry slates with information on the various issues for sale and meet with clients, much like a broker does today.Venetian merchants introduced the principle of exchanging debts between moneylenders; a lender looking to unload a high-risk, high-interest loan might exchange it for a different loan with another lender. These lenders also bought government debt issues.As the natural evolution of their business continued, the lenders began to sell debt issues to the first individual investors in the late 1900s. The Venetians were the leaders in the field and the first to start trading securities from other governments, yet did not embark on private trade with India. Nor did the Italians connect on land with the Chinese Silk Road. Along the potential overland trade route, Habsburg emperor Frederick II repulsed advances by Mongol Batu Kahn in 1241. There is little consensus among scholars as to when corporate stock was first traded. Some view the key event as the Dutch East India Company's founding in 1602, while others point to much earlier developments. The first book in history of securities exchange, the Confusion of Confusions, was written by the Dutch-Jewish trader Joseph de la Vega and the Amsterdam Stock Exchange is often considered the oldest modern securities market in the world. On the other hand, economist Ulrike Malmendier of the University of California at Berkeley argues that a share market existed as far back as ancient Rome, that derives from Etruscan Argentari. In the Roman Republic, which existed for centuries before the Empire was founded, there were societates publicanorum, organizations of contractors or leaseholders who performed temple-building and other services for the government. One such service was the feeding of geese on the Capitoline Hill as a reward to the birds after their honking warned of a Gallic invasion in 390 B.C. Participants in such organizations had partes or shares, a concept mentioned various times by the statesman and orator Cicero. In one speech, Cicero mentions shares that had a very high price at the time. Such evidence, in Malmendier's view, suggests the instruments were tradable, with fluctuating values based on an organization's success. The societas declined into obscurity in the time of the emperors, as most of their services were taken over by direct agents of the state. Tradable bonds as a commonly used type of security were a more recent innovation, spearheaded by the Italian city-states of the late medieval and early Renaissance periods.

more...